– Second Quarter Revenues of $12.9 Million (down 0.6% yoy) And Share in NPI Revenue Interests of $8.5 Million (up 434% yoy) totaling $21.4 Million

(up 47.0% yoy) –

– Second Quarter Net Income of $0.11 Per Share –

– Second Quarter Adjusted EBITDA1 of $8.3 Million (up 6.6% yoy) –

– Raises Full Year 2021 Revenue and Share in NPI Revenues Interest Guidance to between $75 and $79 Million –

LUXEMBOURG, Aug. 11, 2021 (GLOBE NEWSWIRE) — NeoGames S.A. (Nasdaq: NGMS) (“NeoGames” or the “Company”), a technology-driven provider of end-to-end iLottery solutions, announced today financial results for the second quarter ended June 30, 2021.

Moti Malul, Chief Executive Officer of NeoGames, said: “We are increasingly encouraged by the performance and development of the various markets and customers we support, notwithstanding expected seasonal impacts during the quarter. In particular, this quarter has seen continued strong growth in Alberta, where new gaming verticals were added, as well as further expansion of our games content into new markets and customers with contracts in Ukraine and Italy, which prove the market leading position of our offering.”

“Our substantial growth and strong performance over the past year gives us confidence that we are well positioned to maintain our position as the premier innovator and provider of iLottery solutions to the global lottery industry. As we continue to prove the effectiveness of our offering in engaging and maintaining players as well as enabling state and local governments to generate more revenue they can deploy for public benefit. We are proud and honored that our achievements are recognized by the industry, demonstrated by our recent win of the EGR B2B Awards as the Best Lottery Supplier for 2021. We are confident that we will continue to be the first choice for both full-service offerings and content relationships as additional

jurisdictions see the value iLottery can offer.”

Second Quarter 2021 Financial Highlights

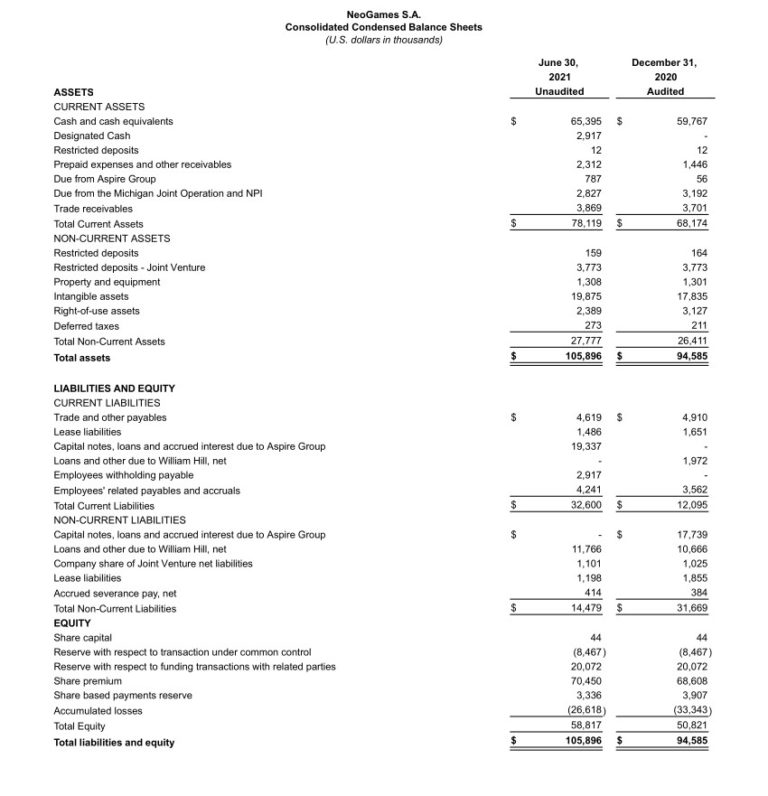

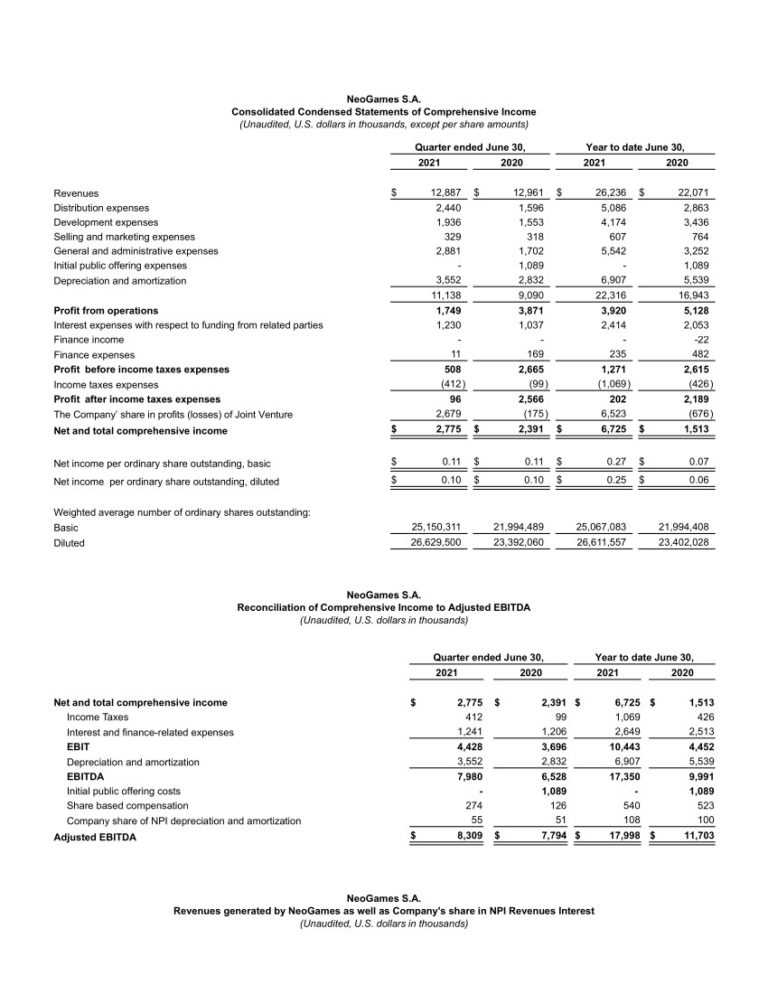

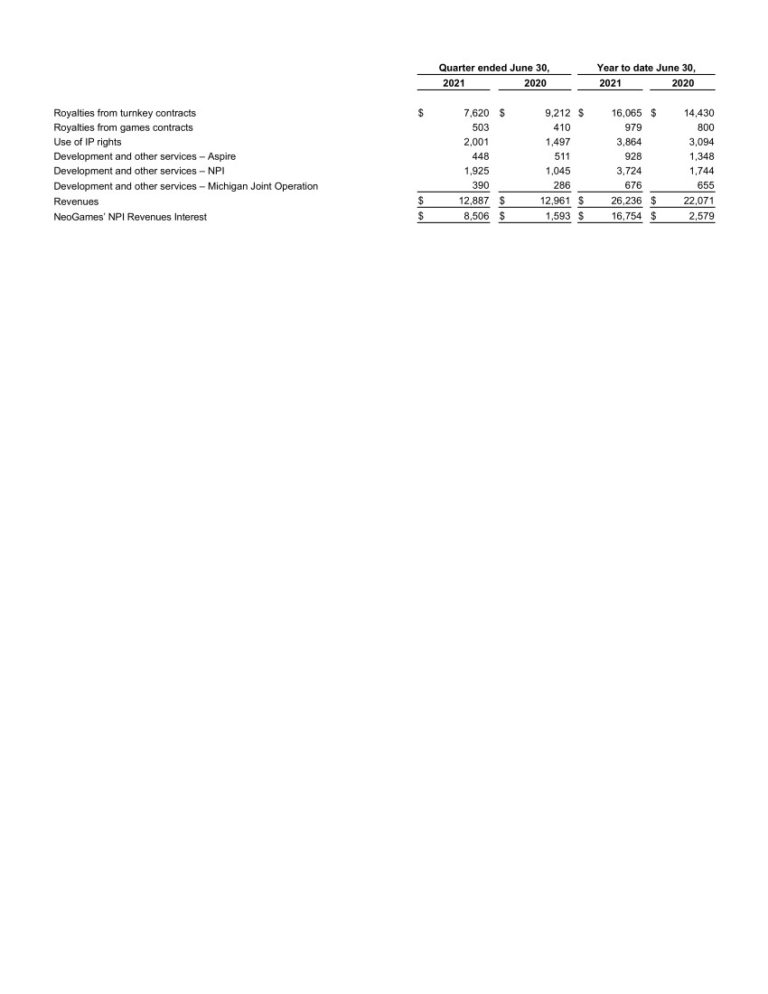

- Revenues were $12.9 million during the second quarter of 2021, compared to $13.0 million during the second quarter of 2020, representing a decrease of 0.6% year-over-year. In addition, the Company’s share of NPI revenues was $8.5 million during the second quarter of 2021, compared to $1.6 million during the second quarter of 2020, representing an increase of 434% year-over-year. The total of revenues and the Company’s share of NPI’s revenues was $21.4 million during the second quarter of 2021 compared to $14.6 million during the second quarter of 2020, representing an increase of 47.0% year-over-year.

- Comprehensive income was $2.8 million, or $0.11 per share, during the second quarter of 2021, compared to comprehensive income of $2.4 million, or $0.11 per share, during the second quarter of 2020.

- Adjusted EBITDA was $8.3 million during the second quarter of 2021, compared to an Adjusted EBITDA of $7.8 million during the second quarter of 2020, representing an increase of 6.6% year-over-year.(1)

- Network NGR was $187 million during the second quarter of 2021, compared to $112 million during the second quarter of 2020, representing an increase of 67.2% year-over-year.(1)

(1) Adjusted figures represent non-IFRS information. See “Non-IFRS Financial Measures” and the tables at the end of this release for an explanation of the adjustments and reconciliations to the comparable IFRS numbers.

Second Quarter 2021 Business Highlights

- Performance in Alberta has continued to exceed expectations during the province’s third live quarter. A successful launch of draw games and growth in existing and new players continue to drive the customer.

- Signed contract with Lottomatica in Italy to provide its successful eInstant games portfolio.

- Subsequent to quarter-end, signed contract to enter the Ukrainian market through a deal with Ukrainian National Lottery UNL, illustrating the international appeal of our content.

- Chosen as the 2021 EGR B2B Award winner for Best Lottery Supplier.

- Appointed Christopher G. Shaban, a senior lottery industry professional, as EVP Sales, Marketing and Customer Development.

- Subsequent to quarter end, launched Multi-Game progressive jackpot for eInstants.

Guidance

The Company is raising its fiscal year 2021 Revenue and Share in NPI Revenues Interest Guidance to between $75 million and $79 million, compared to the prior range of between $73 million and $77 million.

Conference Call & Webcast Details

NeoGames will host a live conference call and audio webcast on Thursday, August 12, 2021 at 8:30 a.m. Eastern Time, during which management will discuss the Company’s second quarter results and provide commentary on business performance. A question and answer session will follow the prepared remarks.

The conference call may be accessed by dialing (833) 301-1152 for U.S. domestic callers or (914) 987-7393 for international callers. Once connected with the operator, please provide the conference ID of 8593557.

A live audio webcast of the earnings conference call may be accessed on the Company’s website at ir.neogames.com. The replay of the audio webcast and accompanying presentation will be available on the Company’s investor relations website shortly after the call.

About NeoGames

NeoGames is a technology-driven innovator and a global provider of iLottery solutions for national and state-regulated lotteries. NeoGames’ full-service solution combines proprietary technology platforms with the experience and expertise required for successful iLottery operations. NeoGames’ pioneering game studio encompasses an extensive portfolio of engaging online lottery games that deliver an entertaining player experience. As a trusted partner to lotteries worldwide, the Company works with its customers to maximize their success, offering a comprehensive solution that empowers them to deliver enjoyable and profitable iLottery programs to their players, generate more revenue, and direct proceeds to good causes.

Forward-looking Statements

Certain statements in this press release may constitute “forward-looking” statements and information, within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, which involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. These factors include, but are not limited to the risk factors discussed under the heading “Risk Factors” in our prospectus related to our initial public offering, filed with the Securities and Exchange Commission (“SEC”) on November 20, 2020, and other documents filed with or furnished to the SEC. When used in this document, such statements include such words as “may,” “will,” “expect,” “believe,” “plan,” and other similar terminology.

These statements reflect management’s current expectations regarding future events and operating performance and speak only as of the date of this document. Other than as required by law, there should not be an expectation that such information will in all circumstances be updated, supplemented, or revised whether as a result of new information, changing circumstances, future events, or otherwise.

Non-IFRS Financial Measures

This press release includes EBIT, EBITDA, Adjusted EBITDA, Network NGR, NPI and NPI Revenues Interest, which are financial measures not presented in accordance with IFRS. We use these financial measures to supplement our results presented in accordance with IFRS. We include these non-IFRS financial measures because they are used by our management to evaluate our operating performance and trends and to make strategic decisions regarding the allocation of capital and new investments.

EBIT, EBITDA, and Adjusted EBITDA. We define “EBIT” as net income (loss), plus income taxes, and interest and finance-related expenses. We define “EBITDA” as EBIT, plus depreciation and amortization. We define Adjusted EBITDA as EBITDA, plus share-based compensation, initial public offering charges and the Company’s share of NPI’s depreciation and amortization. We believe EBIT, EBITDA and Adjusted EBITDA are useful in evaluating our operating performance, as they are regularly used by security analysts, institutional investors and others in analyzing operating performance and prospects. Adjusted EBITDA is not intended to be a substitute for any IFRS financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry.

Network NGR. We define “NGR” as (i) in North America, gross sales less winnings paid to players and any promotion dollar incentives granted to players, and (ii) in Europe, gross sales less winnings paid to players, any gambling tax or duty paid on such sales and any promotion dollar incentives granted to players. We measure Network NGR as the total NGR generated by Instants and DBGs on our platform. As most of our revenue share contracts are based on NGR, tracking Network NGR provides us with insight as to the marginal contribution of GGR growth to our revenues and allows us to detect inefficiencies in our GGR growth strategy.

NPI. Refers to NeoPollard Interactive LLC that represents the Company’s 50/50 joint venture with Pollard Banknote Limited (“Pollard”). The joint venture was formed for the purpose of identifying, pursuing, winning and executing iLottery contracts in the North American lottery market. NPI is managed by an executive board of four members, consisting of two members appointed by NeoGames and two members appointed by Pollard. NPI has its own general manager and dedicated workforce and operates as a separate entity. However, it relies on NeoGames and Pollard for certain services, such as technology development, business operations and support services from NeoGames and corporate services, including legal, banking and certain human resources services, from Pollard.

NPI Revenues Interest. NPI Revenues Interest is not recorded as revenues in our consolidated statements of comprehensive income, but rather is reflected in our consolidated financial statements in accordance with the equity method, as we share 50% of the profit (loss) of NPI subject to certain adjustments.

CONTACTS:

Investor contact:

ir@neogames.com

Media Relations:

pr@neogames.com

More in Media

NeoGames Appoints Christopher G. Shaban as EVP Sales, Marketing and Customer Development

24 Year Lottery Industry Senior Executive to Lead All Aspects of Customer Engagement LUXEMBOURG, June 07, 2021 (GLOBE NEWSWIRE) — NeoGames S.A., (Nasdaq: NGMS) (“NeoGames”

Successful Launch With AGLC Marks NPi’s Entry To Canadian Gaming Market

LANSING, Michigan, November 17, 2020 /CNW/ – NeoPollard Interactive LLC (“NeoPollard Interactive” or “NPi”) is proud to announce its successful launch into the Canadian market

NeoGames wins 2021 EGR B2B award for Best Lottery Supplier in the industry

Luxembourg, July 13, 2021— NeoGames S.A. (Nasdaq: NGMS) (“NeoGames” or the “Company”), a technology-driven provider of end-to-end iLottery solutions, is proud to announce being chosen